Showing 20 posts from October 2015.

Court of Chancery Applies Business Judgment Standard Under New Supreme Court Precedent

In re Zale Corporation Stockholders Litigation, C.A. 9388-VCP (October 29, 2015)

This is an important decision that reverses a prior opinion in the same case. The Court did so because after it issued its prior opinion, the Delaware Supreme Court issued its Corwin decision holding that when a merger is approved by a disinterested Board and a majority of the fully informed stockholders, the business judgment standard of review applies. This Court concluded that under that standard, the Board’s actions were not grossly negligent.

ShareCourt Of Chancery Applies Wal-Mart Decision

Kops v. The Bank of New York Mellon Corporation, C.A. 10102-VCG (Transcript, July 16, 2015)

This recently released transcript has a good explanation of how to apply the Garner/Wal-Mart principles governing when stockholders may get discovery of documents otherwise subject to the attorney-client privilege. The multiple facts involved, particularly in a Section 220 case, tend to permit such discovery when the issue is whether demand is excused to file a derivative suit. More ›

ShareMorris James Receives Christopher W. White 2015 Distinguished Access to Justice Leadership Award

Morris James LLP was presented the Leadership Award at the Delaware State Bar Association’s Christopher W. White 2015 Distinguished Access to Justice Awards Breakfast on October 29th, 2015. The Leadership Award is given to the firm who has demonstrated outstanding leadership in the field of pro bono service to the impoverished in Delaware, and who fosters a culture which recognizes the value of Access to Justice service. More ›

Morris James LLP was presented the Leadership Award at the Delaware State Bar Association’s Christopher W. White 2015 Distinguished Access to Justice Awards Breakfast on October 29th, 2015. The Leadership Award is given to the firm who has demonstrated outstanding leadership in the field of pro bono service to the impoverished in Delaware, and who fosters a culture which recognizes the value of Access to Justice service. More ›

Court Of Chancery Accepts Merger Price In Appraisal Action

Merion Capital LP v. BMC Software Inc., C.A. 8900-VCG (October 21, 2015)

This decision illustrates the dangers of appraisal arbitration. More ›

ShareCourt of Chancery Again Explains Claim Against An Investment Banker

In Re Tibco Software Inc. Stockholders Litigation, C.A 10319-CB (October 20, 2015)

In this unusual factual circumstance, the Court denied a motion to dismiss a claim against an investment banker for aiding and abetting a board’s alleged breach of its duty to act with care. Note that the board itself was dismissed because, even if it violated its duty of care, the exculpation clause in the corporate charter immunized it from liability. More ›

ShareCourt Of Chancery Holds Section 205 Is Limited To Validating Action

IN RE Genelux Corporation, C.A. 10042-VCP (October 22, 2015)

In a case of first impression, the Court holds that Section 205 of the DGCL can only be used to validate defective corporate actions, not to declare an action invalid. While a similar claim might be made in a Section 225 case, there are limits to who may bring such a claim, so this decision does make a real difference.

ShareCourt Of Chancery Explains When Director May Bring An Advancement Case

IN RE Genelux Corporation, C.A. 10612-VCP (October 22, 2015)

This is another example of when a director may seek advancement when he is acting affirmatively and not merely as a defendant.

ShareCourt Of Chancery Reverses Director Resignation

Martin v. Med-Dev Corporation, C.A. 10525-VCP (October 27, 2015)

In this unusual case, the Court of Chancery has reinstated a director who was tricked into resigning. The opinion has a good discussion of how directors may resign and when their resignation is not effective.

ShareSixteen Morris James Lawyers Recognized in Delaware Today's "Top Lawyers 2015"

Morris James LLP is pleased to congratulate the lawyers listed below, who were most recommended by their professional peers in a survey of Delaware attorneys conducted by Delaware Today magazine. Sixteen Morris James attorneys were distinguished in their respective practice areas, with seven named as “top vote-getters,” listed below in bold. More ›

Morris James LLP is pleased to congratulate the lawyers listed below, who were most recommended by their professional peers in a survey of Delaware attorneys conducted by Delaware Today magazine. Sixteen Morris James attorneys were distinguished in their respective practice areas, with seven named as “top vote-getters,” listed below in bold. More ›

Court Of Chancery Explains Jurisdiction

Mirosoft Corporation v. Patent Revenue Partners LLC, C.A. 8092-VCP (October 15, 2015)

It is often assumed that merely by registering an entity in Delaware as part of a business transaction that you have become subject to the jurisdiction of the Delaware courts. But as this decision points out, that is not as simple as you might think. More ›

ShareThe Increasing Role of Equity in Delaware LLC Litigation

October 2015

Jason C. Jowers, Meghan A. Adams

Business Law Today

In the October 2015 issue of Business Law Today, an article authored by Jason C. Jowers and Meghan A. Adams examines the increasing role of equity in LLC litigation. Both the case law and an amendment to the Delaware LLC Act in recent years demonstrate Delaware's rejection of a solely contractarian view of LLCs. The recent Delaware Court of Chancery decision of In re Carlisle Etcetera LLC provides new lessons on the subject of equity's reach. Although the length of equity's powerful arm into the area of LLC litigation may surprise some practitioners, there is a consistent theme in the case law that may provide comfort: the Court of Chancery normally will only exercise its equitable powers when the parties have left gaps in their operating agreement.

This article was originally published in the American Bar Association Business Law Section's "Business Law Today."

ShareDelaware Courts Continue to Excel in Business Litigation with the Success of the Complex Commercial Litigation Division of the Superior Court

American Bar Association, Section of Business Law, The Business Lawyer

70 The Business Lawyer 1059 (Fall 2015)

Joseph R. Slights, III and Elizabeth A. Powers wrote an article published in the Volume 70, Number 4, Fall 2015 edition of the ABA Business Law Section's The Business Lawyer. Their article was titled "Delaware Courts Continue to Excel in Business Litigation with the Success of the Complex Commercial Litigation Division of the Superior Court." This article discusses the relatively new Delaware Superior Court's Complex Commercial Litigation Division ("CCLD") and its reputation as a premier business court in keeping with the Delaware judiciary’s tradition of excellence in the resolution of corporate and business controversies. The article further analyzes the benefits and advantages of the CCLD, as it offers litigants an alternative venue for complex commercial litigation where equitable jurisdiction is lacking. The authors conclude that thus far business litigants have embraced the CCLD due to its flexibility and responsiveness to the needs of the particular case.

Business Judgment Standard for Disinterested-Stockholder Approval

The Delaware Supreme Court in Corwin v. KKR Financial Holdings LLC, No. 629, 2014 (Del., October 2, 2015), issued an important opinion authored by Chief Justice Leo E. Strine Jr. resolving uncertainty about the effect fully informed, disinterested shareholder approval has on the judicial review of a transaction. Specifically, the court ruled that in a merger transaction with a party other than a controlling shareholder, the voluntary, informed judgment of the disinterested shareholders to approve the transaction will invoke the business judgment rule standard of review. Thus, even if the board of directors is not independent and disinterested, and in the absence of a valid disclosure or waste claim, the approving shareholder vote will permit pleading-stage dismissal of the claims against the directors. More ›

The Delaware Supreme Court in Corwin v. KKR Financial Holdings LLC, No. 629, 2014 (Del., October 2, 2015), issued an important opinion authored by Chief Justice Leo E. Strine Jr. resolving uncertainty about the effect fully informed, disinterested shareholder approval has on the judicial review of a transaction. Specifically, the court ruled that in a merger transaction with a party other than a controlling shareholder, the voluntary, informed judgment of the disinterested shareholders to approve the transaction will invoke the business judgment rule standard of review. Thus, even if the board of directors is not independent and disinterested, and in the absence of a valid disclosure or waste claim, the approving shareholder vote will permit pleading-stage dismissal of the claims against the directors. More ›

Judicial Dissolution: Are the Court of the State that Brought You In the Only Courts that Can Take You Out?

American Bar Association, Section of Business Law, The Business Lawyer

70 The Business Lawyer 1059 (Fall 2015)

Peter B. Ladig co-authored an article published in the Volume 70, Number 4, Fall 2015 edition of the ABA Business Law Section's The Business Lawyer. Their article was titled "Judicial Dissolution: Are the Courts of the State that Brought You In the Only Courts that Can Take You Out?" This article discusses whether a state court can judicially dissolve an entity formed under the laws of another state. The recent dissolution of Interstate General Media, LLC, the limited liability company that owned The Philadelphia Inquirer, the Philadelphia Daily News, and the website philly.com, brought to light the issue of which court should hear the request for dissolution after two simultaneous actions were filed in the Commerce Court of the Philadelphia Court of Common Pleas and the Court of Chancery of the State of Delaware. They also analyze the historical attitude toward dissolution of domestic entities and why dissolution is different from other types of claims.

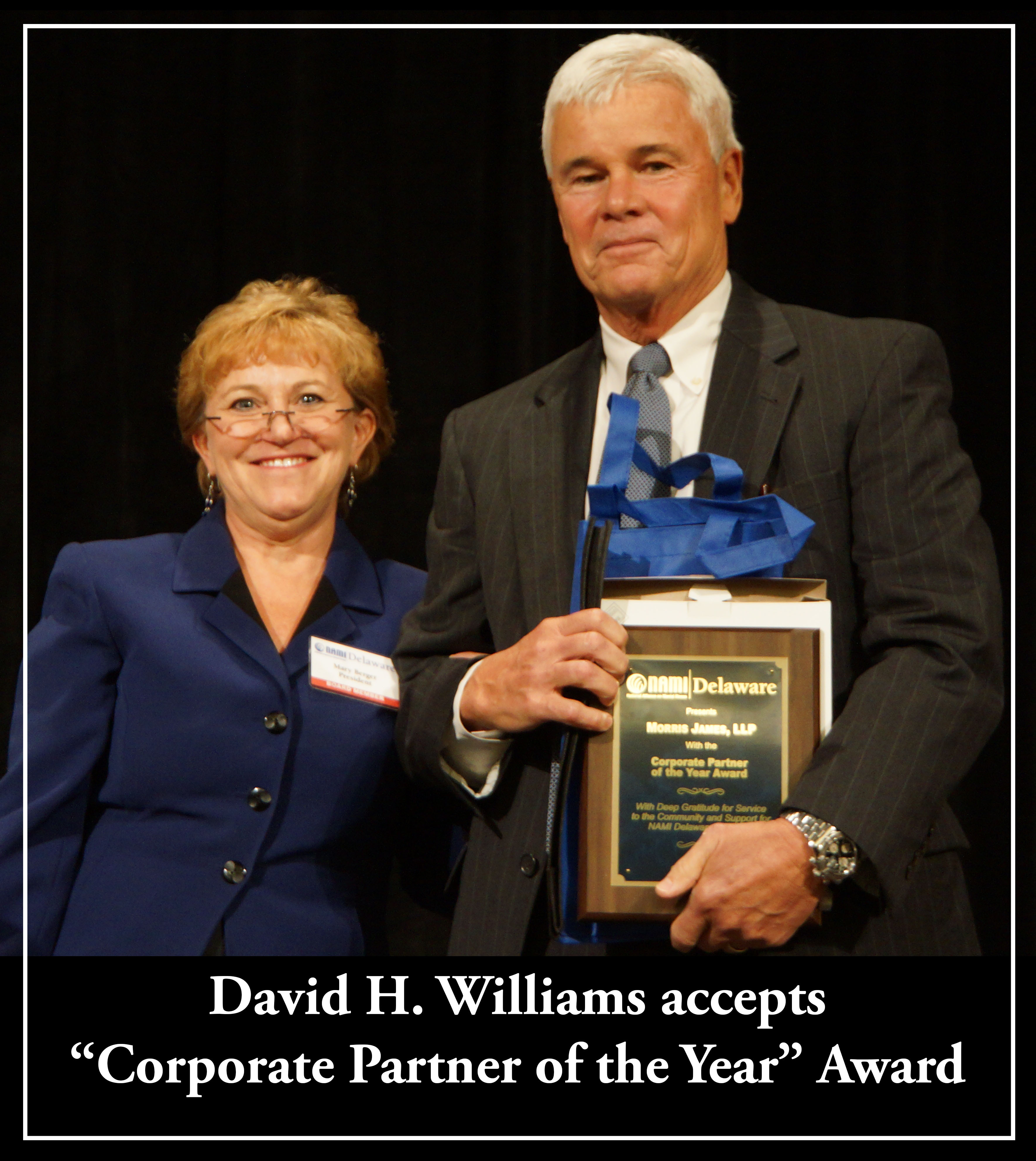

Morris James LLP Receives NAMI Delaware’s "Corporate Partner of the Year" Award

The National Alliance on Mental Illness (NAMI) of Delaware has recognized Morris James as its “Corporate Partner of the Year.” Managing partner, David H. Williams, accepted this award given in recognition for the firm’s service to the community and support for NAMI Delaware’s mission. National Alliance on Mental Illness (NAMI) is a nonprofit group that raises money and awareness for the treatment of people with mental illness. Over the past 13 years, a dedicated team of Morris James employees has raised money each year in the NAMI Delaware Walk. Margie Touchton, a long-term employee, has led Morris James’ effort which contributes money to fund people in group homes around the state. More ›

ShareFraud Vitiated Special-Committee Process in Dole Merger

In a self-interested transaction between a company and its controlling stockholder, the operative standard of judicial review under Delaware law is the most rigorous: entire fairness standard of review. To obtain the least rigorous, business judgment standard of review, and reduce the risk of a minority stockholder challenge in a merger transaction between a company and its controlling stockholder, parties may condition the controlling stockholder merger on approval by: (1) a board committee composed of disinterested and independent directors and (2) the affirmative vote of a majority of the minority or unaffiliated stockholders (In re MFW Shareholders Litigation, 67 A.3d 496 (Del. Ch. 2013), aff'd sub nom., Kahn v. M&F Worldwide, 88 A.3d 635 (Del. 2014)). Similarly, parties may employ either one of these safeguards to shift the burden of proof to the plaintiff under the entire fairness standard of review (Emerald Partners v. Berlin, 787 A.2d 85, 98-99 (Del. 2001)). Moreover, a well-functioning special committee advised by its own independent financial and legal advisers, and/or an affirmative vote of a majority of the minority or unaffiliated stockholders makes a stronger case to support a finding of fair dealing or process, which in turn influences the fair price inquiry to satisfy entire fairness review. More ›

In a self-interested transaction between a company and its controlling stockholder, the operative standard of judicial review under Delaware law is the most rigorous: entire fairness standard of review. To obtain the least rigorous, business judgment standard of review, and reduce the risk of a minority stockholder challenge in a merger transaction between a company and its controlling stockholder, parties may condition the controlling stockholder merger on approval by: (1) a board committee composed of disinterested and independent directors and (2) the affirmative vote of a majority of the minority or unaffiliated stockholders (In re MFW Shareholders Litigation, 67 A.3d 496 (Del. Ch. 2013), aff'd sub nom., Kahn v. M&F Worldwide, 88 A.3d 635 (Del. 2014)). Similarly, parties may employ either one of these safeguards to shift the burden of proof to the plaintiff under the entire fairness standard of review (Emerald Partners v. Berlin, 787 A.2d 85, 98-99 (Del. 2001)). Moreover, a well-functioning special committee advised by its own independent financial and legal advisers, and/or an affirmative vote of a majority of the minority or unaffiliated stockholders makes a stronger case to support a finding of fair dealing or process, which in turn influences the fair price inquiry to satisfy entire fairness review. More ›

Court Of Chancery Explains How To Interpret A Contract

Hartley v. Consolidated Glass Holdings Inc., C.A. 9360-VCN (September 30, 2015)

This is a great case for an explanation of how a court should go about interpreting an ambiguous contract. It explains how extrinsic evidence is used and the role of the good faith negotiator principle.

ShareDelaware Supreme Court Resolves KKR-Gantler Confusion

Corwin v. KKR Financial Holdings LLC, No. 629, 2014 (October 2, 2015)

There has been some debate about the effect of an approval by a majority of a company’s stockholders of a transaction with an unrelated third party - does that invoke the Business Judgment Rule? The question arose over different interpretations of two Supreme Court decisions in the Gantler and other KKR cases. This decision settles the debate by firmly holding that majority stockholder approval does invoke the BJR standard of review at least when the stockholders are fully informed.

ShareDelaware Supreme Court Explains How To Do The Director Interest Test

Delaware Country Employees Retirement Fund v. Sanchez, No. 702, 2014 (October 2, 2015)

Deciding if a director is sufficiently tied to a controller so as to be disqualified from passing on a transaction independently is an important decision because it may determine if a derivative suit meets the demand excuse test. More ›

ShareCourt Of Chancery Upholds Contribution Claim

Konstantino v. AngioScore Inc., C.A. 9681-CB (October 2, 2015)

This interesting decision both explains the conspiracy theory of jurisdiction and upholds an equitable contribution claim by the company required to advance fees to a director to have the director’s companies contribute toward those fees. This occurs when the second company has benefited by the conduct of the director acting for it.

Share