What is Business Divorce?

Most times, a business divorce is exactly what you think it is: a legal proceeding in which two or more business partners sever their business relationship. While on its face it is “just business,” the business divorce often creates as much emotional drama as a divorce between spouses. Knowing when, how and why the partners need to separate their interests is critical to guiding people through situations that may need a business divorce.

Before discussing how to obtain a business divorce, it probably makes sense to describe some common situations in which a business divorce is either necessary or makes sense. Sometimes the need for a business divorce is not evident before further investigation of the situation.

- You have a business partner with an equal interest in your company, but you no longer get along, and he literally has locked you out of the business. How do you resolve the discord between you?

- You and another investor are the lead investors of a group that bought an operating company. Although the company is run by a board, your operating agreement requires all major decisions be approved by both lead investors. At first everything was rosy, but now the shine has worn off, and your relationship with the other lead investor has soured. You cannot agree on any decision but important decisions need to be made promptly or the business will suffer. What are your options to break the deadlock between you and the other lead investor?

- You ran a successful hedge fund until you decided to “retire” by managing the existing investments in the fund and allow your former business partner to use the fund’s name and strategies in his new fund, and the employees would work for both funds. After a few months, you realize that your former partner is cannibalizing all of the employees’ time for his investments, leaving you with very little support. In addition to the agreement permitting your former partner to use the name, strategies and employees, he also has a sizeable carried interest your old fund, so all the work you do to maximize the investments will have to be shared with him while he undermines you at the same time. How can you unravel the relationship so that neither party has any continuing obligation to the other?

Conventionally, a business divorce means a court-ordered dissolution of the entity through which the parties do business. But court-ordered dissolution of the business relationship is not always possible. Sometimes, a disgruntled business partner must use other methods in addition to the judicial process to cause the separation to occur. If used properly, these methods can create leverage. Whether a true business divorce is possible and, if not, what other techniques might be available to force a practical end to the relationship depends on the form of the entity and the parties’ written agreements. Therefore, the lawyer advising the person seeking a business divorce must know the judicial and non-judicial rights available under the applicable statutory scheme and under the bylaws, certificate of incorporation, stockholder agreement, voting agreement, operating agreement or partnership agreement applicable to the situation. Some cases do not present themselves as a “business divorce,” but cry out for that remedy.

When is a true Business Divorce an option?

As discussed above, the manner in which an unhappy business partner can seek a business divorce depends in large part on the type of entity. Most business divorces involve corporations, limited liability companies (“LLCs”) or limited partnerships (“LPs”), although they can involve traditional general partnerships. In Delaware, it is hardest to obtain a true “business divorce” for a corporation unless the corporation is equally owned by two stockholders, commonly referred to as “50-50 ownership.” In that scenario, Delaware has a specific statute applicable to 50-50 ownership situations that permits one stockholder to petition the court for an order dissolving the company.[1] If the corporation is not 50-50 ownership, Delaware does not have a specific statute under which a stockholder may seek dissolution of the entity. Delaware does, however, have a statute that permits a stockholder to seek appointment of a custodian if the stockholders are deadlocked and cannot elect new directors or the board is deadlocked and the shareholders cannot terminate the deadlock.[2] Although the statute does not expressly mention that the custodian appointed under the statute could sell the company, recently Delaware courts have appointed custodians under the statute for the purpose of selling the company to resolve the deadlock between the parties.

Members of Delaware limited liability companies and partners of Delaware limited partnerships have more flexibility in seeking dissolution of their respective entities than stockholders of a Delaware corporation. The applicable statutes permit the Court of Chancery to dissolve the entity if it is no longer reasonably practicable to carry on the business in conformity with the operating or partnership agreement. This most common situation satisfying this standard is deadlock among the persons operating the entity. Even when deadlock is present, the court will first look to the parties’ agreement to determine whether they agreed in advance on how a disgruntled member or partner could exit the business. If there is no exit provision in the agreement or the exit provision would cause an inequitable result, the court is more likely to exercise its discretion to dissolve the entity. In one case, although the LLC agreement had an exit provision, if the unhappy member exercised it, he would not have been relieved of his personal guarantee on the mortgage for the company’s property. The court found that this result was unfair to the departing member because he had no control over the operation of the business to avoid liability under the mortgage.

LLCs and LPs also can be dissolved under these statutes if there is a failure of the business purpose leading to some inequity. For instance, the court agreed to dissolve a LLC formed to market, distribute and sell natural beef although there was no deadlock among the members because the member that was supposed to supply the beef to the company terminated the supply contract and announced it intended to compete with the company. As a result, the LLC had no source of beef and could not obtain a new one because a clause in the LLC agreement required the manager to act in the best interests of the members. The court reasoned that this unfair result required the court to exercise its discretion to dissolve the LLC.

Other Methods of Achieving the Goal

Although it is always advisable to develop a plan prior to filing a lawsuit or taking action that puts you at risk of being sued, it is especially important to do so in a business divorce scenario. While these strategies do not necessarily result in a business divorce ordered by the court, experience shows that pursuing them successfully can result in a negotiated divorce. If the partner is not in control of the company or not part of management, he or she can exercise the right to inspect the books and records of the company. The stockholder, member or partner must state a proper purpose for seeking the documents. In business divorce situations, most people rely on the “investigating possible mismanagement” or “valuing my interest in the company” purpose. The documents produced by the company could serve as the basis for a later lawsuit against the managers or directors. A request to inspect books and records often sparks a discussion between the inquiring person and management about how to resolve any concerns the stockholder might have.

The stockholder, member or partner can file a lawsuit against the persons or entities in control of the company seeking damages for breach of fiduciary duty or the relevant agreements. While these claims, if successful, would not result in an actual separation of the plaintiff from the entity, experience in these cases shows that most defendants recognize that unless the plaintiff is bought out, the plaintiff will keep making these claims. The third scenario at the beginning of this article, with the former hedge fund partners, ended up being resolved by a negotiated separation of interests after both parties realized that they had little appetite for litigation year after year.

Checklist If You Are Considering a Business Divorce

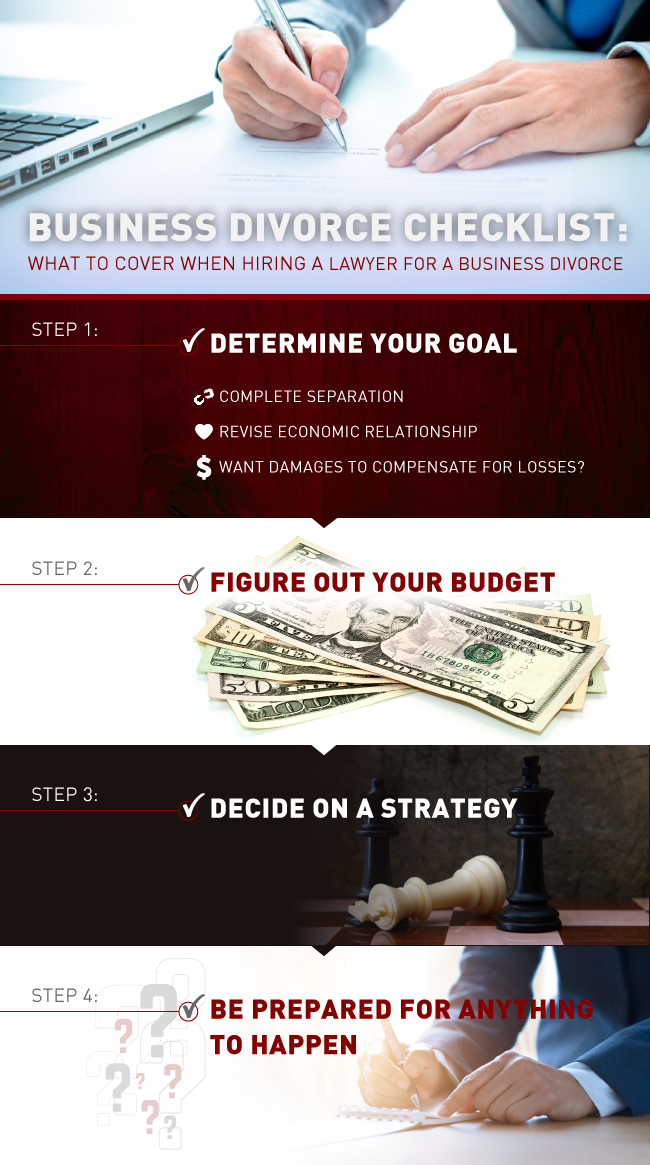

If you are considering seeking a business divorce, there are a few things you must consider before taking any action:

- Figure out what your goal is first. Have a concrete idea of where you want to be at the end of the day. Do you want complete separation? Are you comfortable remaining in a business relationship, but the goal is to revise the economic relationship? Do you just want damages to compensate for losses and are willing to keep the relationship the same? Answering these questions first before taking any steps will help formulate a more coherent and efficient strategy.

- Figure out what your budget is second. As noted above, business divorces are fraught with emotion, often with perceived betrayals by family members or long-time acquaintances. Even sophisticated business people can be driven by emotion in a business divorce. That emotion can lead to the client failing to focus on the economics of the situation – until the first bill arrives. Even then, some business divorce clients continue to make what many would consider to be economically irrational decisions by investing time, resources and money in a strategy that even in the best case scenario would not produce a return justifying the investment. It is important to have a frank conversation at the beginning about what the client intends to spend related to the goal of the exercise to make sure the two have some connection with each other.

- After you have a goal and budget, figure out your strategy. It is important to have a goal and budget before deciding on a strategy because those two considerations drive the strategy. Are you okay with maintaining a business relationship, but you do not have a lot of money to spend and just want to be in control of the company? Maybe instead of litigation, you can get together with other stockholders or members to replace management with new leadership. Do you want to separate completely and don’t care who buys the company if it is sold? A dissolution proceeding may be appropriate. But, if you want to have a say in who the buyer is, then maybe you do not want to seek judicial dissolution because the court will likely install an independent receiver or custodian to manage the process.

- Be prepared for anything to happen. This advice applies to any litigation, but particularly in the business divorce where emotions can cause otherwise rational people to make irrational decisions. While lawyers experienced in business divorce cases can provide a client a reasonable set of expectations, business divorce cases tend to break new ground more than others. Expecting the unexpected can at least soften the impact of an unanticipated action.

This discussion of the aspects of a business divorce is by no means complete. Each case presents unique, interesting and sometimes complicated questions to resolve. A former member of the Court of Chancery has stated that there is no time when it is more important that a client have a good lawyer than when she is considering a business divorce. There are too many examples of clients harming their position by acting without legal advice or with legal advice from lawyers who do not know how to navigate the issues raised by a business divorce. Hopefully, this article shows the reason why getting good legal advice is necessary to anyone involved in a business divorce.

For more information or to speak with an attorney, click here.

[1] 8 Del. C. § 273.

[2] 8 Del. C. § 226. The Delaware Supreme Court has interpreted this statute as evidence that the legislature intended to prevent boards in terminal deadlock from self-perpetuating their control as holdover directors because the stockholders cannot elect successors.