Showing 5 posts in Patient Protection and Affordable Care Act.

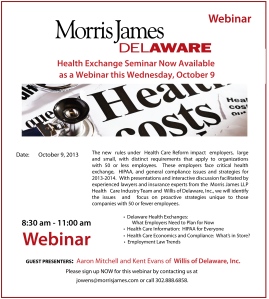

Health Exchange Seminar Now Available as a Webinar this Wednesday, October 9th

Morris James' Healthcare Industry Team will be presenting a webinar on health exchange, HIPAA, and general compliance issues and strategies for 2013-14 on October 9, 2013.

Delaware employers with 50 or fewer employees will identify critical health exchange implementation and learn about other hot topics from presentations and discussions facilitated by Morris James' Healthcare Industry Team and the experienced insurance experts of Willis of Delaware, Inc.

In a timely News Journal story that highlights Walgreens' recent move to send workers to a private health insurance exchange to buy their own plans, consulting firm and industry expert Accenture stated, "In five years, more than a quarter of the estimated 170 million people now covered by insurance through their employers will be getting their benefits this way." Home Depot and Trader Joe's recently announced their move to switch part-time workers to health exchange coverage as well. More ›

Share

Morris James' Healthcare Industry Team will be presenting a webinar on health exchange, HIPAA, and general compliance issues and strategies for 2013-14 on October 9, 2013.

Delaware employers with 50 or fewer employees will identify critical health exchange implementation and learn about other hot topics from presentations and discussions facilitated by Morris James' Healthcare Industry Team and the experienced insurance experts of Willis of Delaware, Inc.

In a timely News Journal story that highlights Walgreens' recent move to send workers to a private health insurance exchange to buy their own plans, consulting firm and industry expert Accenture stated, "In five years, more than a quarter of the estimated 170 million people now covered by insurance through their employers will be getting their benefits this way." Home Depot and Trader Joe's recently announced their move to switch part-time workers to health exchange coverage as well. More ›

Share

Will Delaware Healthcare Exchange Marketplace Follow CA and NY?

Will the Delaware exchange follow New York and California with lower rates than expected? Stay tuned. Launch date is currently January 1, 2014.

Author: A. Kimberly Hoffman, Esq. chairs the Healthcare Industry Team and is a member of the firm’s Real Estate and Land Use Practices at Morris James LLP.

ShareObama Administration’s Final Rules On Wellness Programs

Yesterday, the Obama administration released final rules on employment-based wellness programs as a further implementation of the Affordable Care Act. The final rules purport to support workplace health promotion and prevention as a means to reduce long term costs associated with chronic illness The final rules will be effective for plan years beginning on or after Jan. 1, 2014. The rule was issued May 29. To view the final rule, click here.

Yesterday, the Obama administration released final rules on employment-based wellness programs as a further implementation of the Affordable Care Act. The final rules purport to support workplace health promotion and prevention as a means to reduce long term costs associated with chronic illness The final rules will be effective for plan years beginning on or after Jan. 1, 2014. The rule was issued May 29. To view the final rule, click here.

Author: James H. McMackin III is a Partner in the Employment Law Practice at Morris James LLP.

ShareNon-Binding Resolution May Signal First Step in Repeal of Medical Device Tax

A mere few weeks after its launch, and the Delaware Healthcare Industry Blog is setting the national agenda on Affordable Care Act implementation!

As we bemoaned in a prior blog post, the gradual roll-out of widespread health care reform under the 2010 Patient Protection and Affordable Care Act (the “Affordable Care Act”) saw several new tax increases and other revenue-generating mechanisms come into law in 2013, including a new medical device excise tax. The 2.3 percent excise tax is now assessed on the sales price of most medical devices when purchased from a manufacturer, producer, or importer.

Although the medical device tax remains law, the U.S. Senate took steps on March 21st that demonstrate widespread bipartisan opposition to the new tax:

“The Senate voted 79-20 to call for repeal of the tax, but the resolution is non-binding and will not change the levy. The symbolic measure will be attached to a non-binding budget measure drafted by Senate Democrats that is expected to pass on Friday.Full repeal of the tax may be difficult to achieve, given its $30 billion price tag and the opposition of key Senate Democrats, including Majority Leader Harry Reid.”

Naysayers may point out “nonbinding resolution” is not normally the mark of a D.C. power player (or that “the opposition of key Senate Democrats” includes both of the gentlemen sent to Washington by the Diamond State). Minnesota’s Al Franken – one of the 33 Democratic Senators who joined with all of their Republican colleagues in last month’s purely symbolic vote – is suggesting that more formal legislation may follow. Sen. Franken has good reason for optimism; as the Wall Street Journal points out, the House of Representatives came close to a veto-proof vote on its own anti-medical device tax bill last June. Watch here for further developments!

Author: James J. Gallagher, Esquire is a member of the Tax, Estates and Business Practice at Morris James LLP.

Share