Showing 15 posts from 2013.

Volunteer Emergency Responder Job Protection

On September 6, 2013, Governor Jack Markell signed into law House Bills 21 and 22.

House Bill 2, known as the Volunteer Emergency Responder Job Protection Act, makes it illegal for an employer to discipline or terminate a Volunteer Fire Firefighter or Emergency Management Technician (EMT) who misses work due to injuries received serving the citizens. In addition, an employer cannot discipline or terminate a Volunteer Fire Firefighter or EMT called to serve during a state of emergency called by either the President or Governor.

According to Christiana Fire Company Chief Richard J. Perillo, the idea for the law came from a situation where a company firefighter was fired by a private employer after the firefighter sustained burns to his hands while fighting a house fire last year. The firefighter was unable to return to work for a few days while being treated for his burns and the employer terminated him. More ›

Share

On September 6, 2013, Governor Jack Markell signed into law House Bills 21 and 22.

House Bill 2, known as the Volunteer Emergency Responder Job Protection Act, makes it illegal for an employer to discipline or terminate a Volunteer Fire Firefighter or Emergency Management Technician (EMT) who misses work due to injuries received serving the citizens. In addition, an employer cannot discipline or terminate a Volunteer Fire Firefighter or EMT called to serve during a state of emergency called by either the President or Governor.

According to Christiana Fire Company Chief Richard J. Perillo, the idea for the law came from a situation where a company firefighter was fired by a private employer after the firefighter sustained burns to his hands while fighting a house fire last year. The firefighter was unable to return to work for a few days while being treated for his burns and the employer terminated him. More ›

Share

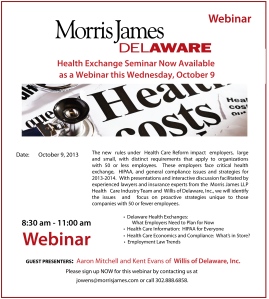

Health Exchange Seminar Now Available as a Webinar this Wednesday, October 9th

Morris James' Healthcare Industry Team will be presenting a webinar on health exchange, HIPAA, and general compliance issues and strategies for 2013-14 on October 9, 2013.

Delaware employers with 50 or fewer employees will identify critical health exchange implementation and learn about other hot topics from presentations and discussions facilitated by Morris James' Healthcare Industry Team and the experienced insurance experts of Willis of Delaware, Inc.

In a timely News Journal story that highlights Walgreens' recent move to send workers to a private health insurance exchange to buy their own plans, consulting firm and industry expert Accenture stated, "In five years, more than a quarter of the estimated 170 million people now covered by insurance through their employers will be getting their benefits this way." Home Depot and Trader Joe's recently announced their move to switch part-time workers to health exchange coverage as well. More ›

Share

Morris James' Healthcare Industry Team will be presenting a webinar on health exchange, HIPAA, and general compliance issues and strategies for 2013-14 on October 9, 2013.

Delaware employers with 50 or fewer employees will identify critical health exchange implementation and learn about other hot topics from presentations and discussions facilitated by Morris James' Healthcare Industry Team and the experienced insurance experts of Willis of Delaware, Inc.

In a timely News Journal story that highlights Walgreens' recent move to send workers to a private health insurance exchange to buy their own plans, consulting firm and industry expert Accenture stated, "In five years, more than a quarter of the estimated 170 million people now covered by insurance through their employers will be getting their benefits this way." Home Depot and Trader Joe's recently announced their move to switch part-time workers to health exchange coverage as well. More ›

Share

Delaware Healthcare Industry 2013 Legislative Roundup

Ambulance Company Rural/Metro Files For Chapter 11 Protection in Delaware

The national healthcare industry often converges on Delaware's bankruptcy courts due to the high number of large companies incorporated here. Private equity-owned Rural/Metro Corp. and more than 50 affiliates ("Debtors") filed Chapter 11 protection on Sunday August 4, 2013 after reaching an agreement with creditors. The Scottsdale, Arizona-based company lists assets and debts of more than $500 million. Fortunately for the Delaware healthcare industry, there are no major local creditors.

The national healthcare industry often converges on Delaware's bankruptcy courts due to the high number of large companies incorporated here. Private equity-owned Rural/Metro Corp. and more than 50 affiliates ("Debtors") filed Chapter 11 protection on Sunday August 4, 2013 after reaching an agreement with creditors. The Scottsdale, Arizona-based company lists assets and debts of more than $500 million. Fortunately for the Delaware healthcare industry, there are no major local creditors.

View the full summary on the Delaware Business Bankruptcy Report.

Author: Eric J. Monzo, Esq. is a member of the Bankruptcy and Creditors' Rights group at Morris James LLP.

ShareNew Delaware Interpretation of Home Health Worker Employment Agreements and Entitlement to Worker’s Compensation, with Drafting Tips

Do you employ home health aides or other travelling employees? Based on a new Delaware Supreme Court case, the terms of these employees’ existing and new employment agreements should be reviewed. The right terms can help protect the employer from excessive worker’s compensation claims, based on a new Delaware Supreme Court case. More ›

Share

Do you employ home health aides or other travelling employees? Based on a new Delaware Supreme Court case, the terms of these employees’ existing and new employment agreements should be reviewed. The right terms can help protect the employer from excessive worker’s compensation claims, based on a new Delaware Supreme Court case. More ›

Share

Will Delaware Healthcare Exchange Marketplace Follow CA and NY?

Will the Delaware exchange follow New York and California with lower rates than expected? Stay tuned. Launch date is currently January 1, 2014.

Author: A. Kimberly Hoffman, Esq. chairs the Healthcare Industry Team and is a member of the firm’s Real Estate and Land Use Practices at Morris James LLP.

ShareGet It In Writing – Even At Mediation: Top 5 Lessons from United Health Alliance

Disputes between health care professionals in a small community like Delaware are particularly well-suited for mediation. The process provides a means for sophisticated litigants to resolve their disputes in private without having to air their “dirty laundry” on the town square. The Morris James Health Care Team routinely urges our clients to participate in mediation in the hopes of avoiding trial. Mediation works. But it can be an exhausting process. At the end of a long mediation that results in settlement, the natural inclination of the parties is to shake hands (or not) and go home with the understanding that the settlement documents will be drafted on another day. Once upon a time a handshake was all that was required to seal a deal. The Chancery Court’s recent decision in United Health Alliance, LLC v. United Medical, LLC, however, is a cautionary tale about going home without a signed agreement. After a brief discussion of this recent Delaware court decision you will find the top 5 takeaways for navigating and avoiding, or successfully mediating, healthcare related disputes. More ›

ShareObama Administration’s Final Rules On Wellness Programs

Yesterday, the Obama administration released final rules on employment-based wellness programs as a further implementation of the Affordable Care Act. The final rules purport to support workplace health promotion and prevention as a means to reduce long term costs associated with chronic illness The final rules will be effective for plan years beginning on or after Jan. 1, 2014. The rule was issued May 29. To view the final rule, click here.

Yesterday, the Obama administration released final rules on employment-based wellness programs as a further implementation of the Affordable Care Act. The final rules purport to support workplace health promotion and prevention as a means to reduce long term costs associated with chronic illness The final rules will be effective for plan years beginning on or after Jan. 1, 2014. The rule was issued May 29. To view the final rule, click here.

Author: James H. McMackin III is a Partner in the Employment Law Practice at Morris James LLP.

ShareManaging Healthcare Litigation: Three Tips for Making Sure Your Money is Well Spent on Experts: Masimo Corporation v. Philips Electronics North America Corporation, et al., C.A. No. 09-80-LPS-MPT, May 20, 2013

Medicare Cutbacks + Delaware's Aging Population: They Are Coming but We're Not Building It (Except Sometimes Below the Canal)

Last year colleague James Landon and I offered up a note of caution in the Urban Lawyer regarding Delaware's "perfect storm" of NIMBY-ism, suburban sprawl, inflexible zoning codes, and Medicare reimbursement rates resulting in zoning policy that excludes the elderly, very sick, and their families from residential communities, nursing care, and social support. We discussed the role of the Fair Housing Act and offered a curative prescription of six features zoning codes should have to ensure meeting Delaware's seniors' needs. We regret to report that while our zoning agenda is going nowhere in any Delaware county or municipality, Delaware’s potential Medicare cost increase due to its aging population will be 457 percent by 2030, according to the May 19, 2013 News Journal. The state did initiate plans to staunch the spending increase: "a system was set up to move people from institutional care back to the community." More ›

Share

Last year colleague James Landon and I offered up a note of caution in the Urban Lawyer regarding Delaware's "perfect storm" of NIMBY-ism, suburban sprawl, inflexible zoning codes, and Medicare reimbursement rates resulting in zoning policy that excludes the elderly, very sick, and their families from residential communities, nursing care, and social support. We discussed the role of the Fair Housing Act and offered a curative prescription of six features zoning codes should have to ensure meeting Delaware's seniors' needs. We regret to report that while our zoning agenda is going nowhere in any Delaware county or municipality, Delaware’s potential Medicare cost increase due to its aging population will be 457 percent by 2030, according to the May 19, 2013 News Journal. The state did initiate plans to staunch the spending increase: "a system was set up to move people from institutional care back to the community." More ›

Share

Non-Binding Resolution May Signal First Step in Repeal of Medical Device Tax

A mere few weeks after its launch, and the Delaware Healthcare Industry Blog is setting the national agenda on Affordable Care Act implementation!

As we bemoaned in a prior blog post, the gradual roll-out of widespread health care reform under the 2010 Patient Protection and Affordable Care Act (the “Affordable Care Act”) saw several new tax increases and other revenue-generating mechanisms come into law in 2013, including a new medical device excise tax. The 2.3 percent excise tax is now assessed on the sales price of most medical devices when purchased from a manufacturer, producer, or importer.

Although the medical device tax remains law, the U.S. Senate took steps on March 21st that demonstrate widespread bipartisan opposition to the new tax:

“The Senate voted 79-20 to call for repeal of the tax, but the resolution is non-binding and will not change the levy. The symbolic measure will be attached to a non-binding budget measure drafted by Senate Democrats that is expected to pass on Friday.Full repeal of the tax may be difficult to achieve, given its $30 billion price tag and the opposition of key Senate Democrats, including Majority Leader Harry Reid.”

Naysayers may point out “nonbinding resolution” is not normally the mark of a D.C. power player (or that “the opposition of key Senate Democrats” includes both of the gentlemen sent to Washington by the Diamond State). Minnesota’s Al Franken – one of the 33 Democratic Senators who joined with all of their Republican colleagues in last month’s purely symbolic vote – is suggesting that more formal legislation may follow. Sen. Franken has good reason for optimism; as the Wall Street Journal points out, the House of Representatives came close to a veto-proof vote on its own anti-medical device tax bill last June. Watch here for further developments!

Author: James J. Gallagher, Esquire is a member of the Tax, Estates and Business Practice at Morris James LLP.

ShareAstra Zeneca Job Losses and Closings: The Impact on Delaware’s Healthcare Industry

![]() As reported by the News Journal, Astra Zeneca is pulling over 1,000 jobs out of Delaware and demolishing its labs on Route 202. Here is a quick hit from the Morris James Healthcare Industry Team on the issues this raises for Delaware’s healthcare industry. Intellectual Property: "Astra Zeneca's business decision demonstrates the impact of federal patent law at the local level. Expiration of many of Astra Zeneca's current drug patents and fewer new drugs in the pipeline that are patent eligible is likely a driver in the business thinking here." Kenneth L. Dorsney, Esq. Intellectual Property More ›

As reported by the News Journal, Astra Zeneca is pulling over 1,000 jobs out of Delaware and demolishing its labs on Route 202. Here is a quick hit from the Morris James Healthcare Industry Team on the issues this raises for Delaware’s healthcare industry. Intellectual Property: "Astra Zeneca's business decision demonstrates the impact of federal patent law at the local level. Expiration of many of Astra Zeneca's current drug patents and fewer new drugs in the pipeline that are patent eligible is likely a driver in the business thinking here." Kenneth L. Dorsney, Esq. Intellectual Property More ›

Creating Valid Post-Employment Restrictions for Physicians in Delaware: Yes You Can!

Now You Know How That Care Got So Affordable - A New Round of PPACA Taxes Began on January 1, 2013 (Part 1)

Among other things, the re-election of President Obama in November ensured that the gradual roll-out of widespread health care reform under the 2010 Patient Protection and Affordable Care Act (the “Affordable Care Act”) would continue into this year. Not only does the Affordable Care Act have far-reaching implications on the delivery of health care services and the provision of health insurance coverage for a large number of Americans, but the legislation also provides for several tax increases and other revenue-generating mechanisms, several targeted specifically at health care-related industries. Certainly many national health insurers affected are Delaware corporations, but the tax impact reaches down to individual physicians, pharmaceutical companies, and even Delawareans who frequent the local tanning salon. More › ShareDelaware Now Requires Nursing Home Emergency Plans

Hurricane Irene blew more than wind and rain into Delaware in 2011. Nursing homes and similar facilities now must have an “all hazards” plan as well as two staff members with FEMA training. We wrote to suggest the “sheltering in place” part of each facility plan include a fully stocked bar, an amenity one of our attorneys enjoyed when stranded on Little Palm Island in a thatched hut during a category 2 hurricane, but that revision did not make it into the final rule. Compliance deadline: contemporaneous with annual renewal for licenses and license applications. 16 DE Admin. Code 3201.

Hurricane Irene blew more than wind and rain into Delaware in 2011. Nursing homes and similar facilities now must have an “all hazards” plan as well as two staff members with FEMA training. We wrote to suggest the “sheltering in place” part of each facility plan include a fully stocked bar, an amenity one of our attorneys enjoyed when stranded on Little Palm Island in a thatched hut during a category 2 hurricane, but that revision did not make it into the final rule. Compliance deadline: contemporaneous with annual renewal for licenses and license applications. 16 DE Admin. Code 3201.

All Delaware Regulations Issued March 2013

Author: The Morris James Health Care Industry Team

Share