What is an equipment finance trust?

An equipment finance trust or equipment trust is a structure where a company establishes a trust—generally a Delaware statutory or common-law trust—for the purpose of owning or leasing one or more pieces of equipment. The assets held by the trust may range from a single aircraft, vessel, crane, or other type of heavy equipment, to an entire fleet of motor vehicles.

The basic structure

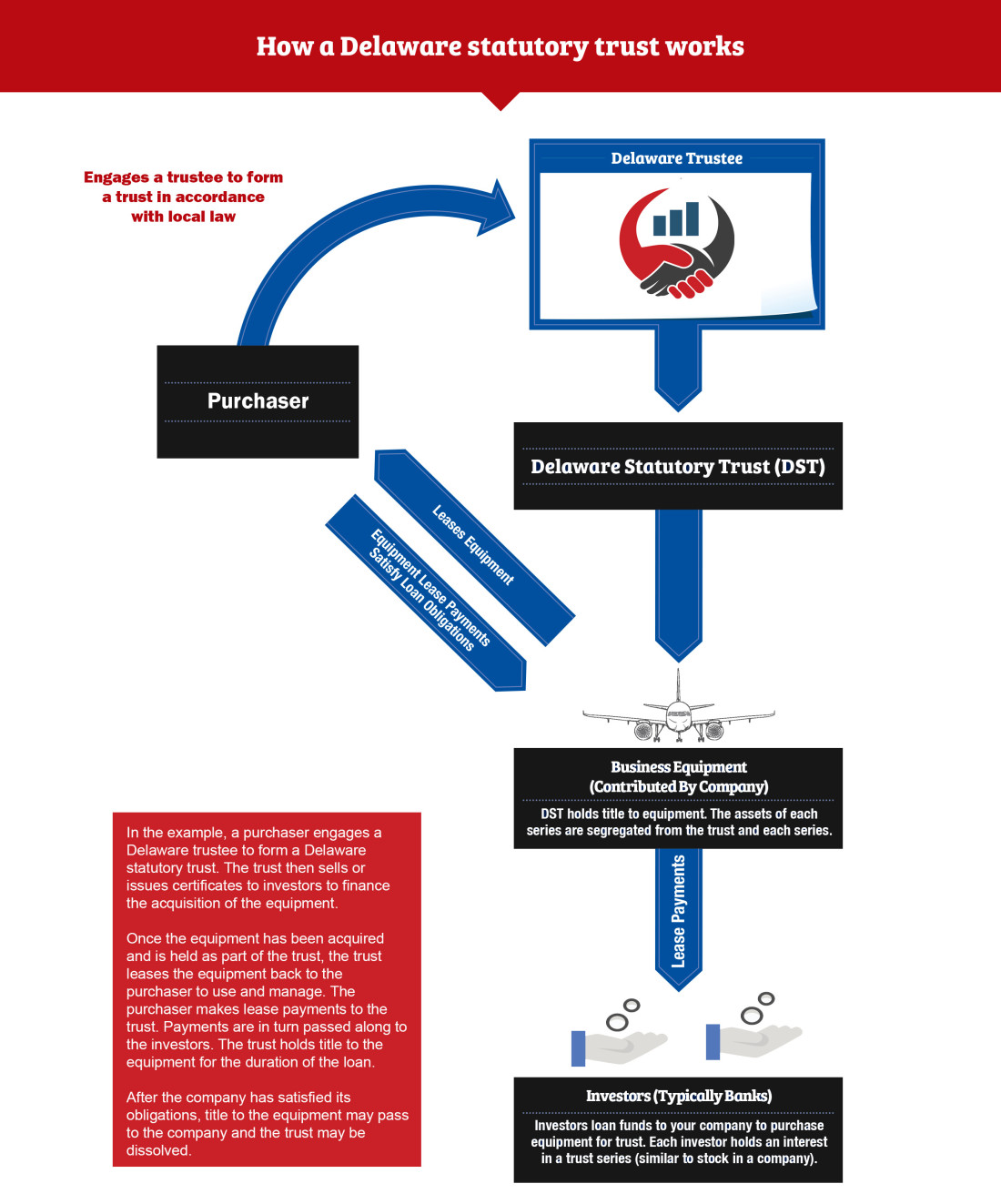

In a typical equipment trust structure, a company engages the services of a trustee to form and maintain a trust in accordance with local law. The trust then sells or issues “trust certificates” to investors to finance the acquisition of the equipment. For investors, these trust certificates represent a beneficial interest in the trust but do not convey title to the equipment or other trust assets. Title to the equipment is vested in the name of the trust or the trustee on behalf of the trust.

Once the equipment has been acquired and is held as part of the trust estate, the trust or the trustee on behalf of the trust typically leases the equipment back to the company to use and manage. The company makes lease payments to the trust (or to the trustee on behalf of the trust), which are then passed on to the investors.

When a trust is properly structured, over the lifetime of the transaction the company’s lease payments will have provided investors with a complete return on their investment, while the equipment remains a useful asset. Once the investors have been paid out, title to the equipment may pass to the company and the trust may be dissolved and terminated.

Using series trusts

Depending on a business’s needs, a number of variations on the basic structure are possible. One such variation involves the use of “series” trusts. Several states, including Delaware, permit the formation of trusts having one or more series of separate assets all held under the umbrella of a single “master” trust.

Unlike a traditional common-law or statutory trust, a series trust allows trust assets to be allocated to one or more sub-accounts, or “series,” within the master trust. Each series, though not considered a separate legal entity under Delaware law, is maintained and accounted for by the trustee independently of the others within the trust. When a series trust is correctly established and administered, the debts, liabilities, obligations, and expenses of a particular series are enforceable only against that series’ assets and not against any other series or general assets of the trust.

In the equipment finance arena, series trusts are often used to title large numbers of assets such as motor vehicle fleets—hence one of their common names, “titling trusts.” In titling trust transactions, a business, typically a leasing company, engages a trustee to form a series trust in accordance with applicable law. The titling trust acquires title to the motor vehicles or other equipment and becomes the registered owner of these assets. The leasing company holds all the beneficial interest in the general trust assets.

The leasing company then instructs the trustee to establish one or more series within the trust and allocate specific motor vehicles or other equipment to each such series. Once the assets have been allocated to a series, the leasing company instructs the trustee to issue beneficial interests in that series to a lender, investors, or even back to the leasing company itself, depending on the goals and purposes of the titling trust. Thus, the assets continue to be owned by the “master” titling trust, eliminating the need to retitle them. The beneficial interest in the master trust assets remains with the leasing company. A third party lender or investor may hold the beneficial interest in assets allocated to a particular series of the trust, and liability and recourse are limited to the series of the trust in which those assets are held.

Are there other benefits to using equipment trusts?

In addition to acting as a financing vehicle, equipment trusts have several other advantages, including their suitability as a mechanism for addressing tax considerations. When equipment is held in an equipment trust, the equipment is owned by the trust and not the company. The equipment cannot be considered property of the company for tax purposes. The leasing company may be able to deduct from its taxes the lease payments it makes to the trust, though of course tax professionals should be consulted. Furthermore, equipment trusts can also be used to address bankruptcy concerns, manage risk, and maintain working capital. Equipment trusts can provide limited liability for equity investors, protect lessees and debt investors against the risk of an equity investor’s bankruptcy, and significantly reduce the risk that the trust will become a debtor in bankruptcy. Further, titling trusts, while a more complex structure to maintain, can reduce the administrative burden associated with retitling assets.

Things to consider when establishing an equipment trust

There are a number of critical components to operating a successful equipment trust, from the strength of the company establishing the trust to the quality of the asset being held. Of equal importance is the selection of the trustee. The trustee must meet not only the basic eligibility qualifications under applicable state law, but also must have the sophistication required to understand the transaction structure and the role of the trustee within that structure. Significant experience with the administration of these types of trusts is a necessity.

The trustee must also be responsive. Because the trust’s beneficial owners are the genuine parties in interest, the trustee generally is not permitted to exercise much (if any) discretion in these transactions. Instead, they act solely at the direction of the beneficial owner or other designated instructing party. Trustees must act quickly on their instructions, as market conditions and other factors can greatly impact the transaction.

Moreover, and of critical importance in the series trust structure described above, the trustee must maintain the trust’s books and records in a clear, concise, organized manner that preserves the separateness of the trust and the series within it. If the trustee fails to properly maintain these records and assets are intermingled, the results can be very detrimental.

A final word

When properly formed and administered, the equipment trust can be a useful tool for businesses seeking alternative methods of financing. Regardless of whether financing is required for a single piece of equipment or an entire fleet, an equipment trust can provide a flexible and beneficial mechanism for businesses.

If you have questions about equipment trusts, contact Shannon Frazier (sfrazier@morrisjames.com; 302.888.6916) or another member of the firm's structured finance team.